Understanding How to Invest in Iran

Why invest in Iran? There are three reasons. First, it is worth investing in Iran because of the market fundamentals. Second, it is worth investing in Iran because for now, others have refrained from doing so. Finally, it is worth investing in Iran in order to make positive change.

Iran is a fundamentally attractive market. It is located in the heart of West Asia, giving it access to regional markets in the Middle East and Central Asia, while also serving as a waypoint for trade between Europe and China. With nearly 83 million people, Iran is the 18th most populated country in the world. Looking to gross domestic product in PPP terms, it ranks as the word’s 23rd largest economy. More than half of GDP is attributed to the services sector, and the economy is diversified, despite Iran having the world’s largest combined oil and gas reserves.

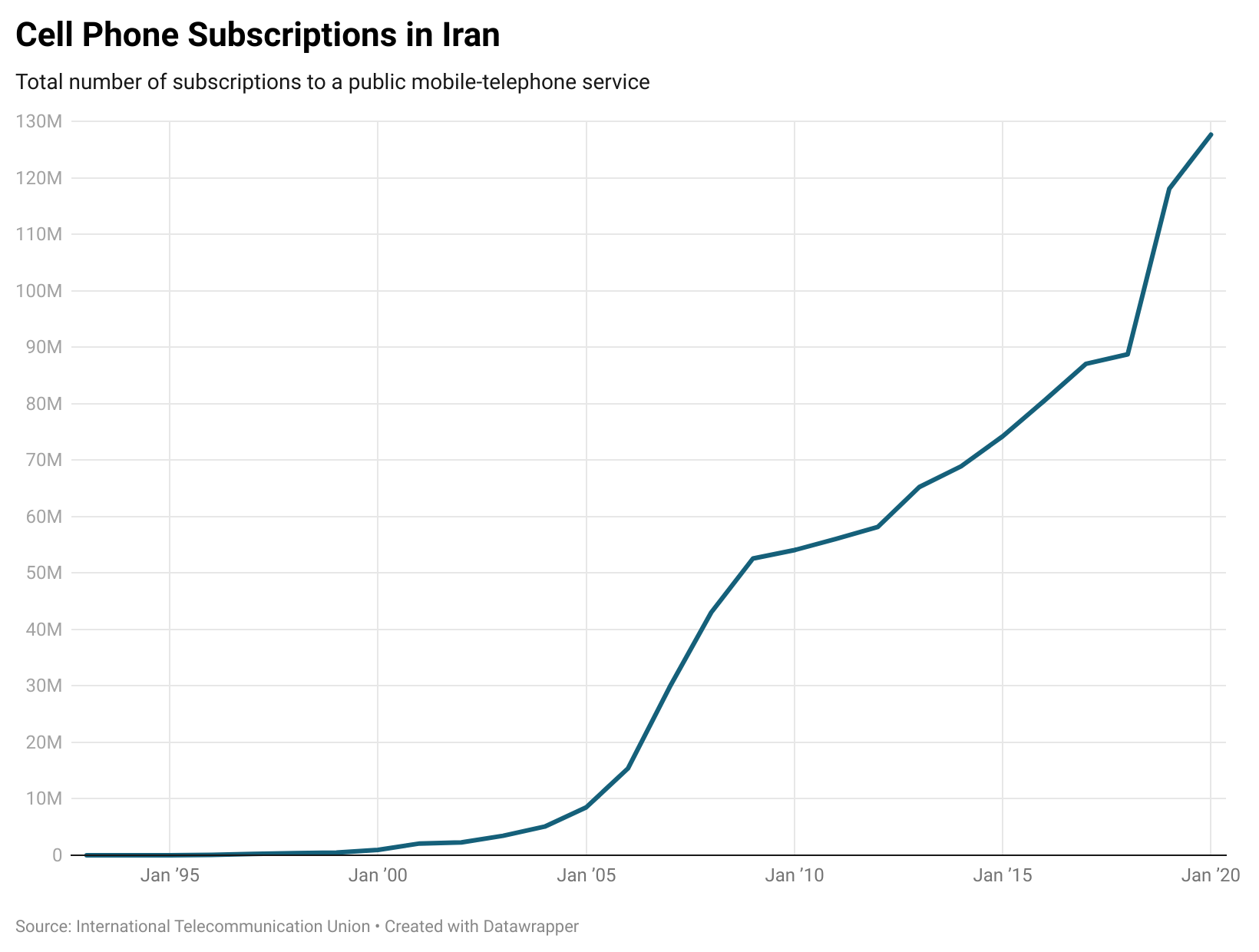

Iranians are young—two-thirds of the population is below the age of 40. They are also highly educated—Iran has the 3rd highest number of engineers per capita in the world. Three-fourths of Iranian live-in cities. There are 127 million cell phone subscriptions and 45 million smart phone users. The penetration of banking services is 94 percent following two decades of rapid development in the financial sector, in which private sector banks play an increasingly large role.

Sanctions are a unique economic challenge facing Iran. But looking long-term there are reasons to optimistic, especially when comparing Iran with similarly-sized neighbours. Iran boasts over $100 billion in foreign exchange reserves, almost ten times the figure for Turkey and five times the figure for Pakistan.

Meanwhile, Iran’s total external debt is just 1.5 percent of GDP, compared with 63 percent in Turkey and 42 percent in Pakistan. Today, sanctions may serve to constrain fiscal space in Iran and delay government investment. But that means that the strong financial performance of many Iranian companies is unrelated to government largesse. Iran will have ample means to increase public spending in the future.

While Iran is a plainly attractive market for investments, particularly in consumer-focused sectors, deploying capital in Iran is not easy. Few investment companies have the necessary local knowledge and relationships to source deals, conduct due diligence, and complete transactions. But this is precisely why those who can invest, should.

Despite offering a very high return on assets, Iran has received very little foreign direct investment in either absolute or relative terms. The country is not on the radar of institutional investors and is not included in MSCI Emerging Markets Index nor the Frontier Markets Index. As a result, the very best Iranian companies are undervalued relative to their performance. Plus, investments in such companies are largely uncorrelated with similar investments in other countries, offering a chance for investors to create more resilient portfolios. In short, it is worth investing in Iran because others have not.

Finally, those investors who have a first-mover advantage, also have a first-mover responsibility. Investing in Iran can open the path for others by presenting a model for responsible investment in the county and by demonstrating the ways in which foreign capital can empower companies that are cognisant of their social responsibilities. In this sense, investments can have a positive impact that cannot be measured in returns.

Photo: Aga Khan Foundation